The gap in how capital is distributed is wide — and it is leaving many good solutions and health tech founders out of the discussion.

While these issues don’t have quick fixes, many firms and organizations have applied different interventions to their processes and practices to address the lack of diversity in health tech founders.

Read Part 1 of the Landscape Analysis Report to learn more about how this problem came to exist.

These different interventions can be sorted into two categories: interventions designed to change investor behavior and interventions designed to support entrepreneurs directly.

In the second part of this three-part series, let’s dig into the Landscape Analysis Report to understand the different interventions being employed around the globe at the investor level to address disparities in fund distribution.

How Do We Know What We Know?

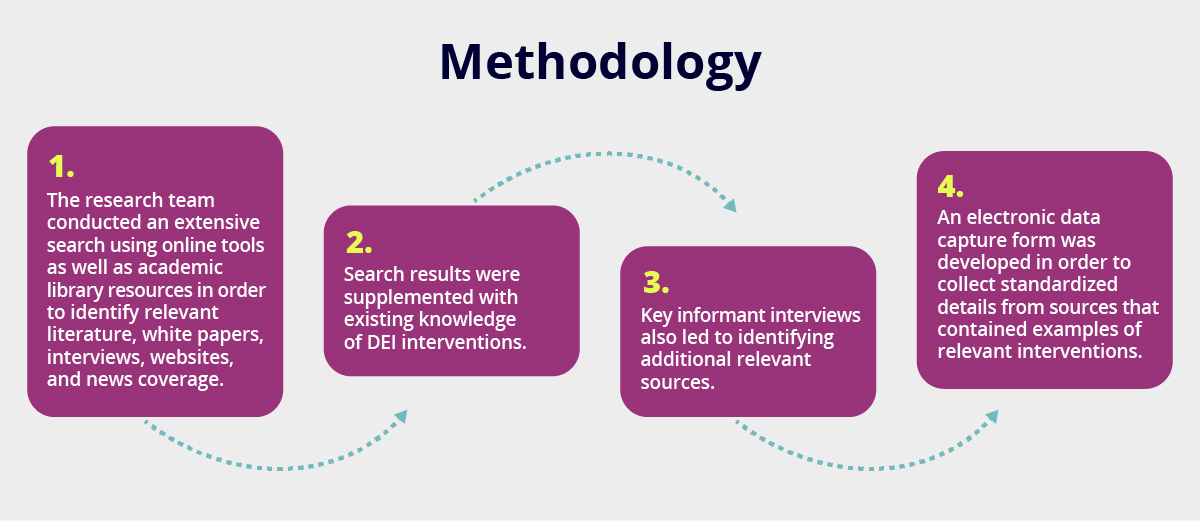

To understand the landscape of current practices and initiatives, authors and founders of HealthTech DEI Kathryne Cooper and Juan Espinoza studied health care and health care analogous industries.

To understand the landscape of current practices and initiatives, authors and founders of HealthTech DEI Kathryne Cooper and Juan Espinoza studied health care and health care analogous industries.

Through this methodology, the research team identified a range of interventions across industries aimed at increasing diversity, inclusion, and equity.

“It should be noted that throughout the research process there was very little outcomes and efficacy data — if or how well the intervention worked — available,” Juan and Kathryne explain. “This is likely due to a combination of factors, including how relatively recent many of these efforts are, and the difficulty in tracking and accessing investing data.”

8 Investor-Focused Solutions and Interventions

The interventions highlighted in the Landscape Analysis Report show that there is work to be done at all levels of a firm or fund. Diversity and equity strategies can be applied to hiring, data collection education, and capital commitments.

Here are 8 investor-focused interventions outlined in the report.

Benchmarking and Effectiveness Data

Benchmarking and Effectiveness Data

One intervention organizations are using to advance equity measures in their firms is to simply measure their outcomes. That which can’t be (or isn’t) measured, can’t be changed, so different software, benchmarks, and approaches emphasize data collection as a tool to improve metrics by looking at variables such as overall employee diversity, salary, and promotion rates cut by demographic.

Training Fellowships

Training Fellowships

Another intervention explored in the Landscape Analysis Report is the creation of training fellowships designed to support diverse rising venture investors entering the field successfully.

Scout Programs

Scout Programs

Scout programs are an additional investor-focused intervention that give individuals support, capital, and community as they enter the VC industry — scouts independently source startups for VC firms and, in many programs, are early-stage investors that directly invest capital into these startups. These programs allow rising investors the opportunity to build their track record through smaller investments.

The Rooney Rule

The Rooney Rule

Intervention ideas that can increase DEI in health tech funding don’t only come from the health care industry. In fact, the Rooney Rule comes from the sports industry. It requires that when hiring for any position (in a firm, for example), an internally specified number of historically underrepresented candidates must be considered.

SUBSCRIBE

Stay in the loop about new blog posts from equitable health innovation leaders, helpful resources and tools to help you bring the Principles to life, upcoming events, and more by joining our email list.

SUBSCRIBE Committing Capital to Diverse General Partners

Committing Capital to Diverse General Partners

Research shows that when funds are managed by diverse general partners, they are more likely to invest in solutions with diverse founders (due to reduced bias and greater understanding of the challenge 46 the business overcomes). Another intervention to increase the diversity of founders funded is to increase the diversity of the general partners managing these funds.

Limited Partner-Driven Directives

Limited Partner-Driven Directives

Interventions to increase diversity in funding is everybody’s responsibility. When investing in firms, limited partners should consider the diversity of fund managers and invest in firms managed by diverse general partners.

Inclusion Initiatives

Inclusion Initiatives

Inclusion initiatives and employee resource groups within investment groups and managed funds can support team members that belong to historically marginalized communities. These groups can tap into your team’s interests while providing a space for networking, career support, personal growth, and education.

Unconscious Bias and Anti-racism Training

Unconscious Bias and Anti-racism Training

While unconscious bias training can check off a box on your firm’s to-do list, it’s not enough to fully address and undo centuries of racist practices, biases, and systems. More comprehensive anti-racism training and anti-racism work, which is a lifelong pursuit of undoing the mental models ingrained in us through living in a racist society, have evolved to help firms and organizations address the deeper roots of inequity in their work and industry.

What’s Next?

Despite these practices and interventions, there has been a statistically insignificant difference regarding the diversity of health tech funders who receive funding. Black, Latinx, and female founders still receive negligible percentages of overall capital invested each year.

While these interventions are a starting point, they in no way represent the end goal. In order to do better, the industry must do better together — at both an investor and entrepreneurial level.

Learn more about interventions for health solution founders in Part 3 of the Landscape Analysis series.

Want to learn more about how your fund can advance equity in your investments? Wondering how to hold your organization accountable for real change? Curious about how effective your current strategies are?

Sign up for HealthTech DEI’s upcoming workshops for 1:1 support and guidance.

SUBSCRIBE

Stay in the loop about new blog posts from equitable health innovation leaders, helpful resources and tools to help you bring the Principles to life, upcoming events, and more by joining our email list.

SUBSCRIBE

Comments are closed.