October 24, 2022

Swimming in the risk pool: A pocket guide to value-based care

At their core, value-based arrangements strive to achieve the Triple Aim (with many calling for a Quadruple Aim) of healthcare by shifting financial risk of care and health outcomes partially or fully to the provider. These financial arrangements are bilaterally agreed upon between insurance companies and/or self-insured group purchasers and provider entities, but can also include life science companies. They’re often anchored around primary care or multispecialty group practices in models designed to focus on total cost of care.

Due to the complexity of contracts, VBC implementation and outcomes measurement have proven to be difficult and results have been mixed. While only five of 54 CMMI value-based models demonstrated cost savings, other multispecialty groups like Heritage Medical Systems have demonstrated success with VBC. With continued market interest, innovative analytics, and strategic partnerships popping up, tech-enabled solutions are driving value-based contracting to a new maturity for managing payment models and delivering quality care. We expect adoption of VBC contracts to grow, especially given the latest CMS strategic plan.

One thing is for certain: if you play in healthcare, VBC will impact the future of your business and how your dollars flow. Because there are various pathways to implementing risk-based contracting, this pocket guide spotlights how digital tools play an essential role in succeeding under value-based arrangements. Do you need an entirely new set of capabilities to build your VBC model from scratch? A bespoke toolkit to meet contractual obligations? Someone to tell you what the contract even says? Your questions for VBC will vary depending on your position in this changing landscape, but innovators are working to answer them. Here’s how:

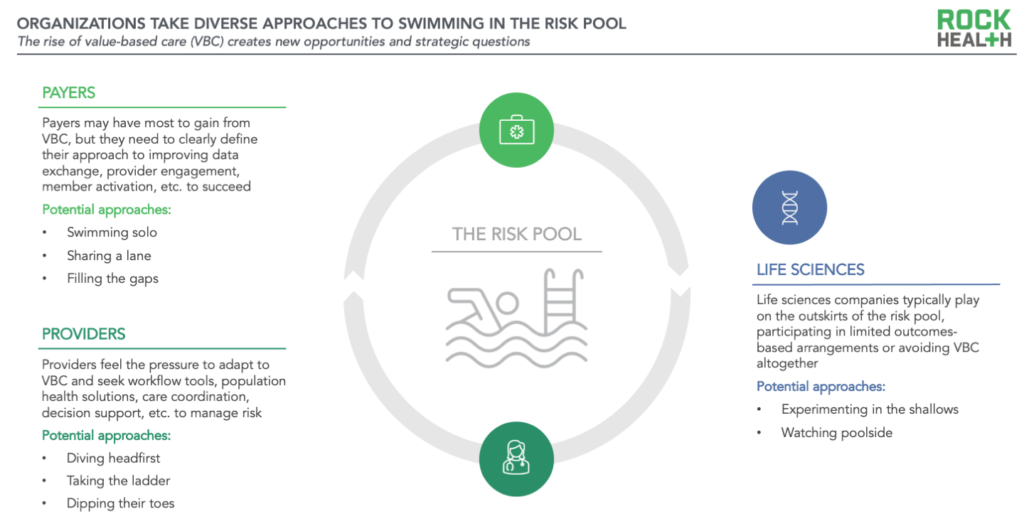

Payers: Determine the approach

Payers (both public and commercial) may have the most to gain from VBC, as they can shift a part of the financial risk and/or care management obligations to other experienced stakeholders. Some arrangements enable payers to outsource or share significant responsibilities (e.g., care coordination, population health, utilization management), move farther upstream (e.g., greater focus on prevention, risk stratification), and cover more integrated services like social determinants of health (SDOH) support, behavioral health offerings, and at-home care. This combination (at least theoretically) decreases both short- and longer-term costs and improves health outcomes. However, not everything is smooth sailing—to succeed in VBC, payers need to make adjustments to their partnerships, tech stack, and operating model, focusing more on contracting, provider enablement, member engagement, analytics, and especially data exchange.

What’s the best swim stroke?

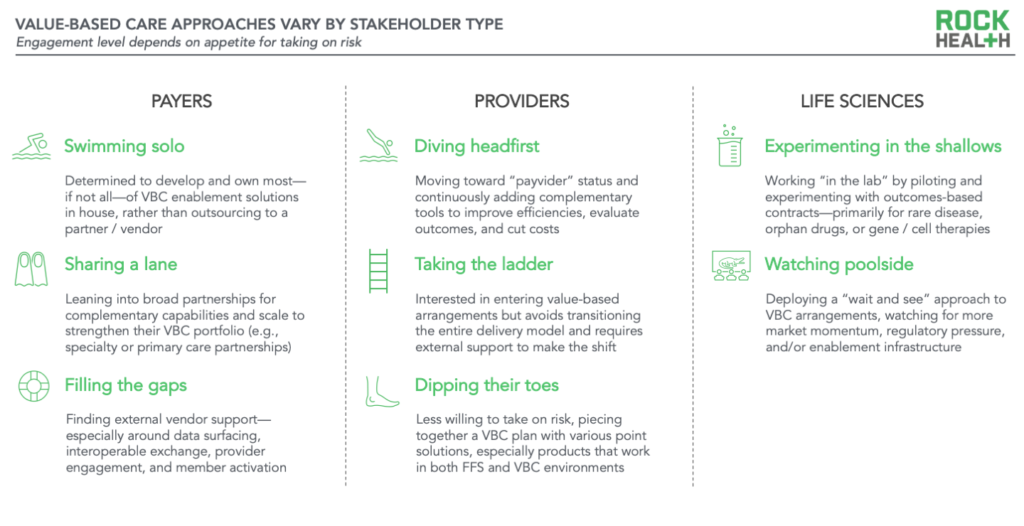

Already swimming in the risk pool, payers are more focused on finding the right VBC approach to stay afloat for the long haul. To that end, payer organizations have deployed a full spread of build-buy-partner strategies.

- Swimming solo: This initial group of payers is determined to develop and own most—if not all—of their VBC enablement solutions. Large players like UnitedHealth Group have launched (or acquired) a wide-ranging portfolio of VBC offerings and care delivery assets, while some “new school” payers have been investing in a digital-native VBC toolkit since their launch. For instance, Clover created Clover Assistant to improve provider engagement and preventive care during patient visits.

- Sharing a lane: Other health plans are leaning into broad partnerships and strategic collaborations. Partnering makes sense for organizations that bring complementary capabilities (and scale) to the table. Some payers are partnering with end-to-end specialty care shops like Somatus, Strive Health, or Thyme Care. Other payers are collaborating with primary care providers like Oak Street, ChenMed, or Iora Health (acquired by One Medical, in turn acquired by Amazon) to strengthen their VBC portfolio.

- Filling the gaps: Most payers though—regardless of where they fall on the build-buy-partner spectrum for their “big moves”—seek external vendor support to fill in the gaps. On the data front, payers are working with players like Moxe1 to simplify payer-provider information exchange, and with Juxly, Holon, Vim, and others on point-of-care data to resolve gaps in care and coding. Leading payer organizations are also collaborating with member engagement solutions like mPulse Mobile, SameSky Health, and Wellth,1 in addition to social care enablers like Socially Determined and Unite Us.

Providers: Determine the risk level

Providers, across health systems, hospitals, and independent providers, are feeling market pressure to adapt to new value-based payment models, and they’re bearing more risk as arrangements mature from performance-based toward full capitation. Providers already have a lot going on (just last year, more than half of providers were experiencing burnout and this year, more than one-third of hospitals have negative operating margins). Even more, the transition to VBC isn’t as easy as signing a new contract. Rather, successful value-based arrangements integrate with practice workflows, interoperate with EHRs, and deliver clinical decision support tools in a meaningful way. Providers looking to adopt new VBC programs should expect major investments in resources for anything from regulatory expertise to population health management.

How deep into the risk pool will you swim?

We’re seeing three responses to deliver on VBC contracts, depending on the level of risk providers are interested in or able to take on. Technology and service companies are supporting their efforts no matter how they enter the risk pool.

- Diving headfirst: The first group of providers wants to do it all, transforming into a payvider and taking on full financial responsibility for patients. Yet, even with full-risk models, providers are continuously adding complementary tools to the toolkit to improve efficiencies, evaluate outcomes, and cut costs. Companies like Cohere Health (which partnered with Geisinger for better utilization management (UM) and AI-enabled prior authorization) have charted a path with incumbents by offering solutions that help integrated systems deliver more efficient care.

- Taking the ladder: The next group of providers in VBC are interested in entering into value-based arrangements but don’t want to transition their entire delivery model. Independent primary care providers, for instance, are looking for solutions for joining networks with new contracts, workflow management, and analytics to meet requirements for VBC. Contracting entities with in-house VBC technologies such as Aledade, Lumeris or Pearl, allow providers to join existing Accountable Care Organizations (ACOs), one of the more common VBC models, while also providing the technical toolkit needed for the transition.

- Dipping their toes: The last group of providers is quite hesitant but may feel as if they have little choice but to take on VBC contracts. They’ll most likely piece together their VBC plan with various enablers. For infrastructure support, these providers may look for interoperability enablers like Redox, b.well Connected Health, or 1UpHealth; for analytics, they may work with vendors like Datavant, Innovaccer, Clarify, or CareJourney. Providers looking to improve ongoing patient support may look to RPM solutions to help keep patients in their home and have success in both the fee-for-service (FFS) and VBC worlds. Ultimately, some of the more risk-averse providers are expected to hold out on risk-based contracting and watch from the pool deck, rather than dive into the risk pool.

Life sciences: Determine the entry point

Each healthcare player can win in VBC in different ways; however, for life sciences companies, gains may be harder to see over a tidal wave of uncertainty. The growing demand from payers and patients for prices that are aligned with health outcomes—in addition to a complicated web of rebates and pharmacy benefit managers (PBMs)—can leave life science leaders with more questions than answers. For example, outcomes-based contracts present biopharma companies with new challenges across the full lifecycle of the arrangement. The contracts are difficult to negotiate (as payers and biopharma do not always agree on which outcomes should be included), difficult to scale (even for mainstream medicines), and difficult to track (even with advancing real world evidence solutions and data tools). Despite the challenges, however, some biopharma companies are proactively looking for their place in the risk pool.

Where (and when) should you play?

- Experimenting in the shallows: The first group of biopharma companies is “in the lab,” committing resources to piloting and experimenting with value- or outcomes-based arrangements. In the early days of outcomes-based contracting, major players focused on broadly used medications. Merck and Aetna, for instance, entered a value-based contract for diabetes drug Januvia, Astrazeneca and Harvard Pilgrim inked two outcomes-based contracts for blood thinner Brilinta and diabetes drug Bydureon, and Eli Lilly and Harvard Pilgrim struck a pay-for-performance agreement for Trulicity. However, biopharma companies have found more recent traction in the domains of rare disease, gene or cell therapy, and orphan drugs where there is often less longitudinal efficacy data. Examples of this include Pfizer’s warranty program (aka the Pfizer Pledge) for rare lung cancer drug Xalkori, and Takeda’s risk-sharing agreement with Point32Health for rare, non-small cell lung cancer drug Alunbrig. New market entrants like Transcarent are spicing up the PBM space by offering fully transparent formularies to employers and health systems.

- Watching poolside: The other group of biopharma companies is deploying a “wait and see” approach to outcomes-based arrangements. They conceptually agree that there should be lower costs and more value and access for patients, but until entrenched incentives between pharmacos and payers / PBMs are realigned, this group is content to wait for more market momentum, regulatory pressure, and/or enablement support.

Some emerging enablement support players are beginning to tackle the edges of the VBC opportunity for life sciences. Evio, for example, is designed to create outcomes-based arrangements with manufacturers, with a focus on high-cost drugs and real-world evidence generation. Novel PBM alternatives such as Flipt, Transcarent, and EmsanaRx are focused on increased transparency and patient centricity, and new tech companies like Chronicled, Lyfegen, and CCX have also entered the scene as potential contract enablers.

Learning to swim in the risk pool

Understanding and implementing VBC is hard, and the literature on VBC shows mixed results. Some studies demonstrate limited evidence of overall cost-savings, and for those that do show cost savings, the amount can be quite small. Beyond changes in cost, some studies find value-based payment models have failed to provide equitable healthcare by penalizing providers who care for Black adults and individuals with lower income. On the flip side, other research shows that ACOs demonstrate both improved care and lower costs.

For those who take the dive into the risk pool and perfect their stride, clear themes emerge from the winners’ circle:

- Decide how (and when) to swim: Start by defining your goals and time horizons for participation in value-based arrangements and ensure alignment on your company’s goals for managing and enabling these arrangements.

- Use the right equipment: Identify and evaluate the data solutions, tech infrastructure, and engagement tools you need to succeed.

- Select winning collaborators: Return back to the basics and determine how you’ll engage across the ecosystem through a buy, build, or partner approach.

We’ll be on the swimlane sidelines rooting you on.

Rock Health Consulting works with enterprise companies on digital health strategy and innovation. For more information, reach out to advisory@rockhealth.com.

Footnote

- Moxe and Wellth are Rock Health portfolio companies.

Comments are closed.